Hydrogen sector: investing in a net zero future

The carbon-free hydrogen revolution sweeping industry is not only driven by technology. Expertise has already been developed in most of the science and processes required. The entire challenge revolves around ramping up production and scaling up the necessary infrastructures and services to support the new uses of this energy carrier.

On the same focus

What are the uses for hydrogen in today's world and the future?

Grey, blue, green... understanding the rainbow of hydrogen colours

Hydrogen: a link in the chain for decarbonising the global economy

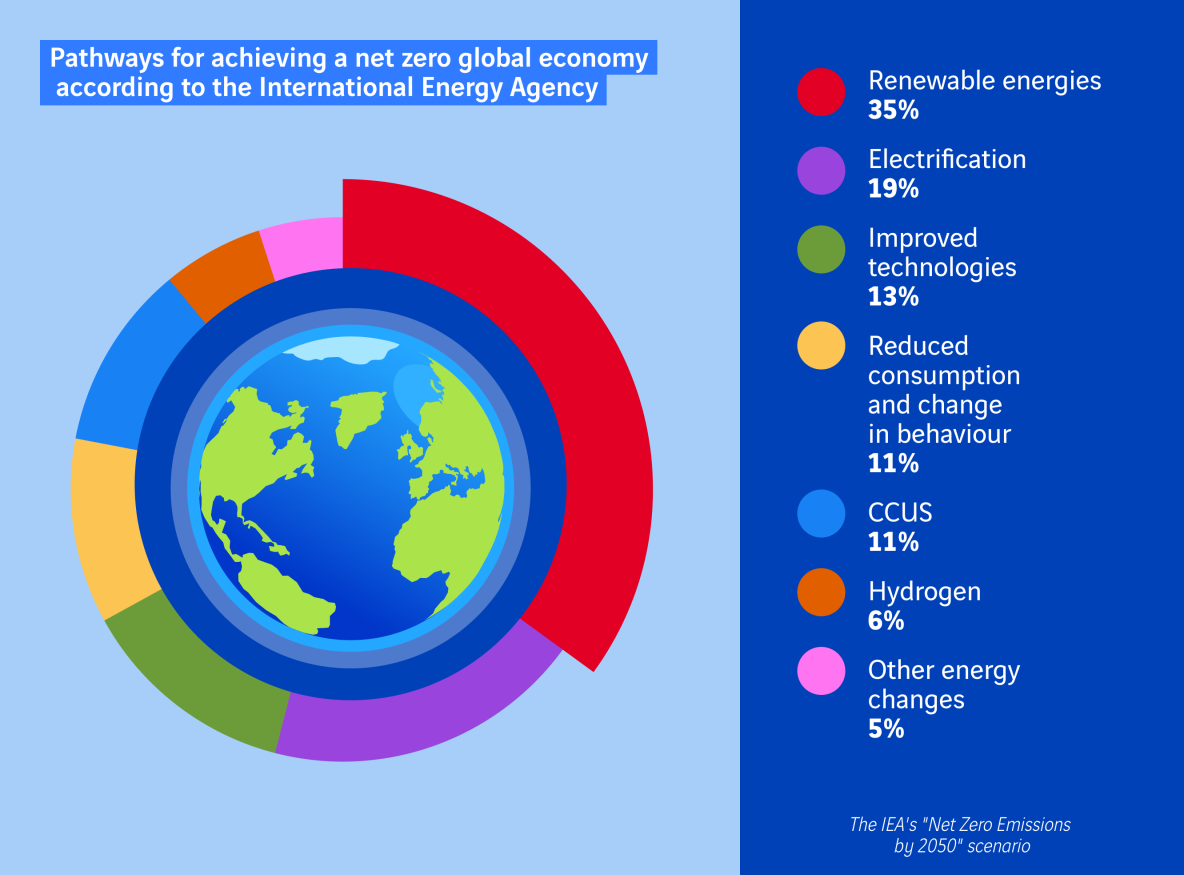

Whatever the scenario for achieving a net zero global economy, hydrogen has a major role to play. Hydrogen is an essential complement to renewable energies and a driving force for decarbonising heavy industries and long-haul transportation. It is also a key component in practically all the climate change strategies spearheaded by governments and the main economic players, alongside initiatives aimed at reducing energy use or satisfying energy needs with electricity produced from carbon-free sources. Hydrogen alone is not a game changer, but part of the puzzle. According to forecasts by the International Energy Agency (IEA), hydrogen represents 6% of the concerted global effort required to achieve net zero emissions by 2050.

What exactly is the hydrogen sector?

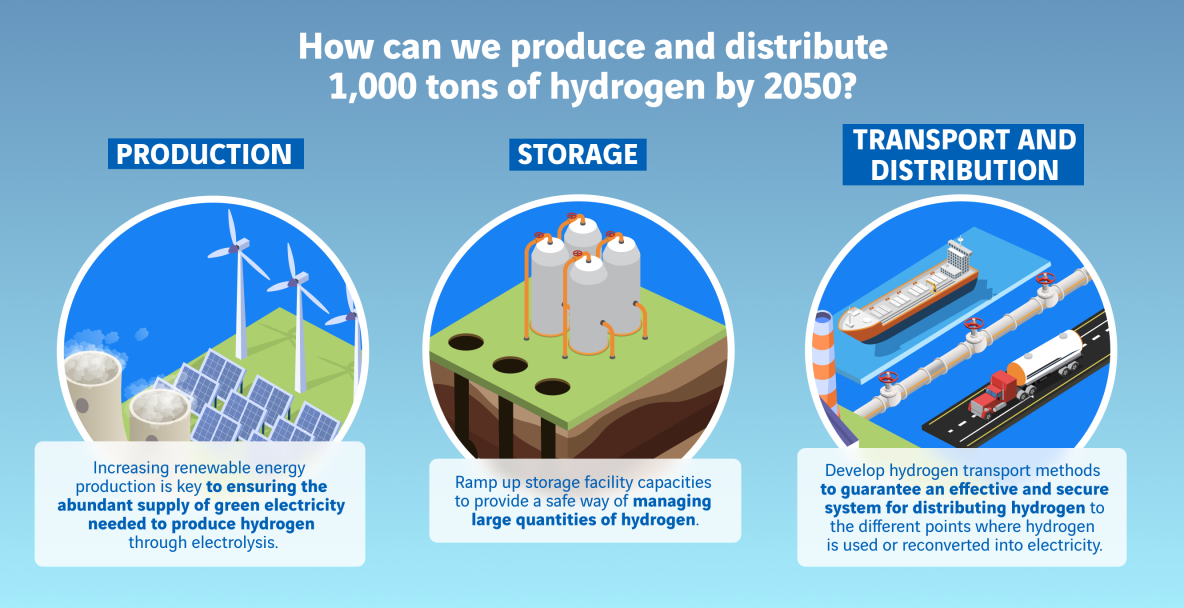

The challenge facing the uptake of hydrogen is one of scale, i.e. increasing the current production capacity of less than 100 tons a year to over 1,000 tons by 2050. In an effort to address the needs for these new uses, while decarbonising production and driving down costs, investments must be made simultaneously in several areas making up the actual hydrogen "sector":

- Promote low-carbon hydrogen production: roll out and optimise electrolysers, and increase renewable electricity production capacities and CCUS systems (carbon capture, utilisation and storage) at industrial sites.

- Develop storage and distribution capacities: refuelling stations, logistics hubs, gas pipelines, underground and surface storage facilities, etc.

- Ensure the industrial-scale development of equipment using hydrogen, such as vehicles, furnaces and boilers.

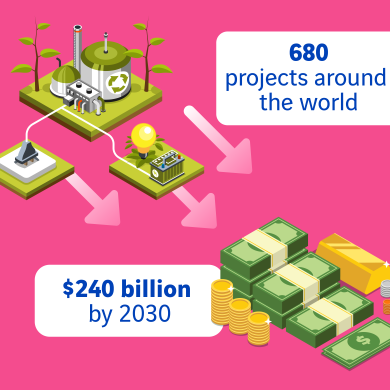

This is the amount of investments required in the hydrogen sector by 2030 to achieve global net zero by 2050.

Regulations and public funding

Governments and public economic actors are in the front line when it comes to setting the wheels of this scaling-up approach in motion. In particular, the idea is to accelerate efforts to align the law and regulations with the hydrogen sector's development objectives. The amount of work required is colossal in such areas as compliance and safety.

The challenge also includes the need to adapt rules within the European Union. At the end of 2021, the EU adopted its new Climate, Energy and Environmental Aid Guidelines (CEEAG). Whereas the Treaty of Rome bans State aid for businesses, the CEEAG allows exceptions when the aim is to facilitate activities with a positive impact on the environment, and some projects combining renewable electricity and electrolysers have already received such aid.

A global movement

have published a hydrogen strategy.

A second major public challenge involves granting incentivising financing packages, which can act as a lever effect for increasing private investments in R&D, demonstrators and innovative industrial projects. The movement is gaining pace on a global scale. For example, despite its name, the US Inflation Reduction Act (IRA) enacted in 2022 is initially aimed at developing climate-friendly technologies with tax credits and $7 billion in funding for creating regional "hydrogen hubs". In Europe, the European Commission proposed a strategy in July 2020 that plans to gradually increase hydrogen's share in the energy mix. This ambition was recently bolstered by the REpowerEU plan that was put forward in the wake of the war in Ukraine to end Europe's reliance on Russian fossil fuels well before 2030. Germany continues to lead the way in this particular area and is banking on a triple increase in hydrogen use by 2050 with plans to invest €7 billion in the sector. In France, major public investment plans are taking shape for the hydrogen sector. Some €7 billion over a 10-year period were set aside in the national strategy announced in July 2020, and an additional €1.9 billion package as part of the France 2030 plan presented in November 2021.

Massive private investments

Empowered by public strategies, the private sector is scaling up its efforts and dedicating a growing percentage of its investments to hydrogen. In all, some 680 large-scale projects, worth a total value of approximately $240 billion, have been put forward for 2030, and 10% are in the advanced stages, i.e. they are operational, under construction or subject to a final investment decision. Around 40% of those investments are focused in the Asia-Pacific region, followed by Europe (roughly 35%). Investments are targeting both upstream production and downstream activities, as well as financing for hydrogen technology suppliers.

The largest clean hydrogen infrastructure fund

Together with Air Liquide, TotalEnergies and other large international corporations, VINCI launched the world's largest fund exclusively dedicated to clean hydrogen infrastructure solutions late 2021. Managed by Hy24 and featuring over €1.5 billion, this fund will invest as a partner, alongside other key project developers and/or industry players, in large upstream and downstream clean hydrogen projects. By engaging international industry players in a number of strategic projects, the fund aims to generate some €15 billion in investments in the sector by 2028.

Most viewed

Explore more

Words from researchers: let's fight stereotypes!

Charlotte, a research fellow at École des Mines, and Erwan, a university professor and researcher at AgroParisTech, talk…

Fondation VINCI pour la Cité: opening the door to others is another way of reaching out!

With some 1.3 million organisations and 2 million employees, France can lay claim to a dynamic network of associations…

Sea water desalination: a solution for turning the tide on the water scarcity crisis?

As water shortages continue causing havoc in a growing number of regions around the world, an age-old idea is experiencing a…